How Much Cash is Needed to Buy a Home?

Machelle Velaski

Purchasing a home can be fun, exciting, yet very overwhelming. You’ve shopped for homes and found one that checks off most or all your wants and needs, but now the BIG questions:

• What will your monthly mortgage payment be?

• How much money do you have to pay immediately?

• How much money will be required at the time of closing on the home?

All of these are great questions that your mortgage lender and real estate agent will be able to help provide answers! Before you get too nervous about how much cash you need to buy a home, check out OPTIONS, noted below, that may be available to ease your pockets!

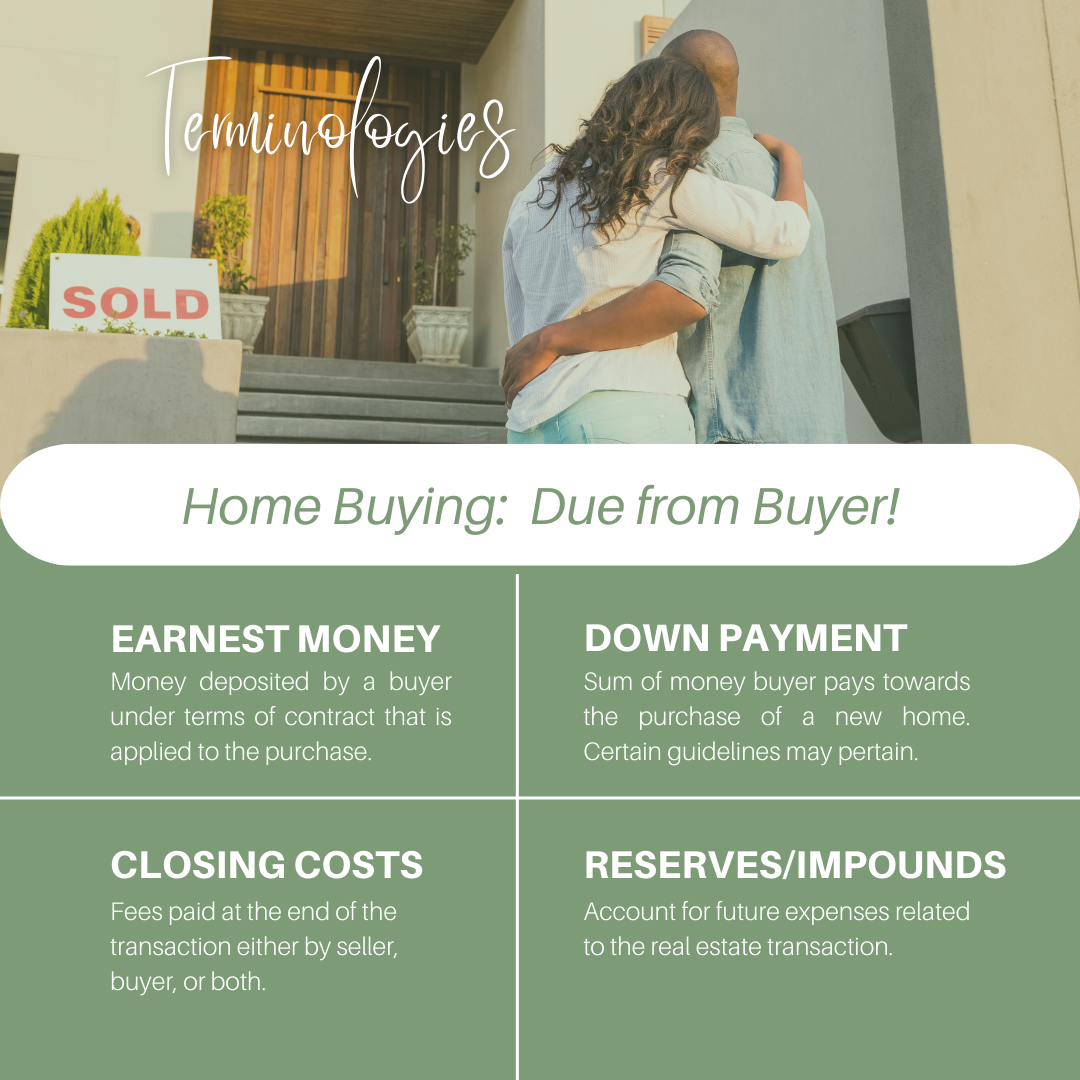

Earnest Money: Money deposited by a buyer under the terms of the purchase agreement. Think of it as a “good faith” deposit as it shows the seller you are serious about purchasing the home. Keep in mind, earnest money could be non-refundable if you/buyer default on the contract. Earnest money is generally 1% of the purchase price of the home (give or take) and is paid to the selling brokerage upon the seller accepting your offer. The earnest money is held in a trust/escrow account until the day you close on your home and is applied to the purchase of your new home.

Closing Costs: Fees and expenses the buyer will pay to secure the mortgage for a new home. The cost of these fees and expenses is generally 2.5% – 5% of the loan amount. Keep in mind, these closing costs DO NOT include your down payment on the home. Examples of fees and expenses may include, but limited to, the following:

1. Loan Charges from your Lender:

a. Loan Origination Fee

b. Underwriting Fee

c. Appraisal

d. Prepaid Interest

e. Credit Report

f. Plat Drawing

g. Flood Certificate, if applicable

h. Discount points

2. Title Charges from the Closing Company:

a. Settlement or Closing Fee

b. Title Opinion Fee – performed by an attorney

c. Lender’s Title Insurance

d. Wire Fee

e. Courier Fee

f. eRecording Fee

3. Government Charges (city & county):

a. Recording Fees

b. Prorated property taxes – MN & ND property taxes are due at different times. In some cases, the buyer may receive a credit from the seller if the current year property taxes have not been already paid.

c. Prorated annual installment specials, if applicable – same rule applies as the prorated property taxes.

4. Miscellaneous:

a. Prorated homeowners’ association membership, if applicable

b. Prorated propane, water, sewer, electric, gas, etc., if applicable

c. Homeowner’s Insurance (additional funds may be required to set aside to an escrow account, if required by your lender – see Reserve/Impounds)

Reserve/Impounds: An account that your mortgage lender may require you to add funds to for payment of future property taxes, specials, and homeowner’s insurance premiums. The goal is that your reserve/impound account has enough funds in it for your lender to pay your homeowners insurance, property taxes, and specials when they are due. In addition to adding funds to this account at the time of closing on your home, you will likely continue to add to this account each month when you make your monthly mortgage payment. Your lender has it calculated as such so your Reserve/Impound account will hold the amount of funds needed. Here are some examples of Reserve/Impounds:

1. Homeowner’s Insurance (1-11 months)

2. Mortgage Insurance

3. Property Taxes (1-3 months)

4. Annual Special Installments (1-3 months)

Down Payment: A sum of money the buyer pays in cash towards the purchase of a new home. The minimum down payment can range from as little as 0%, 3%, 3.5%, depending upon the type of financing you are using to purchase the home. Your mortgage lender will educate you of options and the amount required. As a reminder, your down payment IS NOT part of your closing costs!

So much information!! This is where you are probably hyperventilating and thinking that buying a house will never be in the cards for you…. BUT…. there are OPTIONS!

- Seller-paid Closing Costs or Seller Concessions: A seller may pay money towards the closing costs on YOUR BEHALF. There are guidelines for how much the seller can contribute which is dependent upon the type of financing the buyer is using. Remember when I mentioned that closing costs can be approximately 2.5% – 5% of the home? Well, in some cases, you can ask the seller to pay that amount. Your realtor and mortgage lender will have more information about this for you!

- Home Buyer Assistance Programs: Each state has their own programs that help buyers with their down payment, closing cost assistance, special loans with reduced interest rates, and possibly more options! Your mortgage lender is the best resource for more information; however, make sure that you use a lender that participates in the programs. Check out these links for more information:

– ND Homeownership Programs

– MN Homeownership Programs

REMINDER: The first steps in the home buying process is to find a realtor and lender. Your lender will provide you with a preapproval that explains what you are able to borrow towards a mortgage. Preapproval is important so your realtor can assist you most efficiently. Education about the homebuying process is KEY to a successful transaction with no surprises. Most homebuyers forget about closing costs or think that their down payment and closing costs are the same, but they ARE NOT! After reading this, you now have a leg up on most homebuyers!

HAPPY HOME SEARCHING!!